Current Positions

As at October 2009

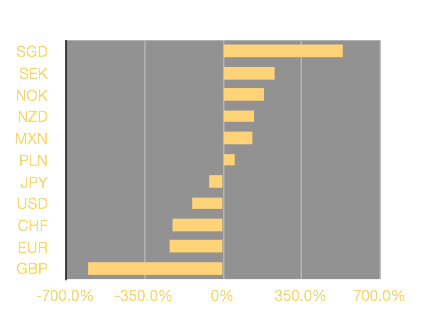

Main theme is being long savers, short borrowers

Still very positive on SGD, as a proxy for Asian currencies, but have redistributed the short from the USD to GBP following the rise in cable

Introduced a new position shorting the NZD into the USD. See Latest thoughts for details

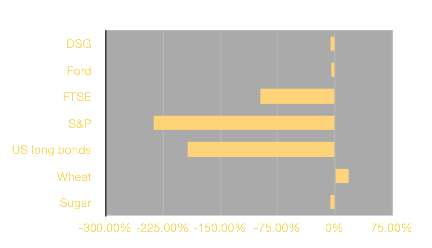

Short US long bonds due to deficit and inflation concerns, unchanged for the month

Remain short equities due to concern about sustainability of growth and the earnings expectations embedded into prices

Short Ford (GM and Chyrsler Chapter 11 gives) them a structural advantage as auto sales will remain permanently below their peak

Introduced a new short - DSG. A UK retailer with poor debt metrics. UK retail will suffer for years

ASSET ALLOCATION

CURRENCY

The scale of the current positions are referenced to the last accumulated return achieved and do not represent total leverage of my balance sheet. These scales are merely intended to give an indication of the strength of my relative views