Current Positions

As at June 2010

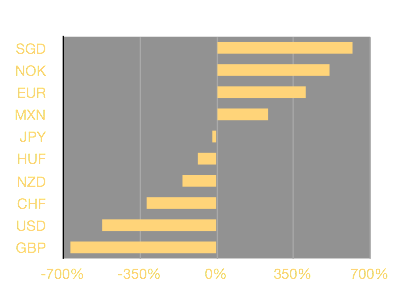

Main theme is being long savers, short borrowers, although this has been trimmed over the last few months.

Still very positive on SGD and MXN out of USD and NZD

The Euro has suffered enough versus the CHF

The Euro maybe cheap versus the USD, but owning NOK out of USd is preferable

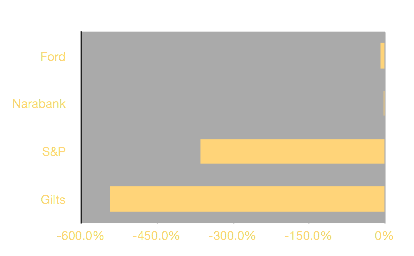

Short equities due to concern about sustainability of growth and the earnings expectations embedded into prices

Bonds are expensive globally and gilts the most vulnerable to an inflation shock

Short Nara Bank reflecting concerns about US Commercial Mortgages

ASSET ALLOCATION

CURRENCY

The scale of the current positions are referenced to the last accumulated return achieved and do not represent total leverage of my balance sheet. These scales are merely intended to give an indication of the strength of my relative views